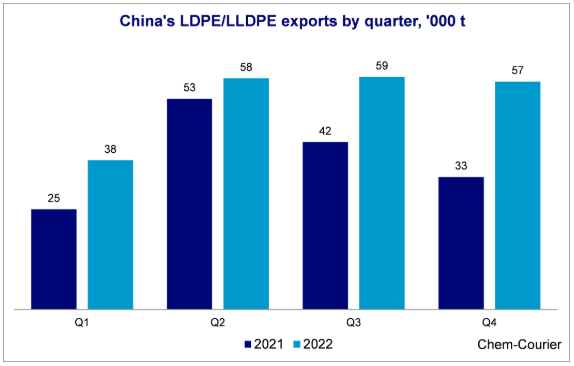

In 2022, exports of Chinese LDPE/LLDPE increased by 38% to 211,539 t compared with the previous year mainly due to weaker domestic demand caused by the COVID-19 restrictions. Furthermore, a slowdown in the Chinese economy and a decrease in operating rates by converters had a significant impact on supplies of LDPE/LLDPE. Many converters were forced to reduce their production or even shut down amid lower buying interest. As a result, the export of these goods became a necessity for Chinese manufacturers to sustain their businesses. Vietnam, the Philippines, Saudi Arabia, Malaysia and Cambodia became the largest importers of Chinese LDPE/LLDPE in 2022. Vietnam enlarged sourcing by 2,840 t to 26,934 t that year on attractive prices for these polymers. The Philippines imported 18,336 then, up 16,608 t. Saudi Arabia almost doubled purchases by 6,786 t to 14,365 t in 2022. Attractive quotes also prompted Malaysia and Cambodia to raise imports by 3,077 t to 11,897 t and by 1,323 t to 11,486 t then.

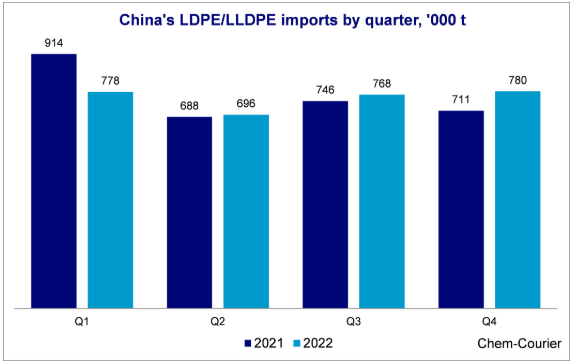

The country’s LDPE/LLDPE imports went 35,693 t down to 3.024 million t in 2022 amid the slacker economy and new plants. Iran, Saudi Arabia, the UAE, the USA and Qatar became the top exporters to China in 2022. Supplies of the Iranian polymers fell by 15,596 t to 739,471 t then. Saudi Arabia lifted sales there by 27,014 t to 375,395 t in 2022. Shipments from the UAE and the USA rose by 20,420 t to 372,450 t and by 76,557 t to 324,280 t then. The US material was one of the most affordable in China in 2022. Qatar sent 317,468 t that year, a 9,738 t increase.

Post time: Apr-12-2023